26+ mortgage payment deferral

A mortgage deferral can also help homeowners whove used forbearance to deal with a temporary hardship. Payment deferral may be an option if you are.

Banks Offering Deferment On Mortgage Payments During Coronavirus

But many say lenders are demanding unfair terms such as massive subsequent lump sum payments that they cant afford.

. Web Housing and credit card payment deferral programs were among the more common plans consumers opted into the survey found. The servicer must report the status of the mortgage loan to the credit bureaus in accordance with the Fair Credit Reporting Act including as amended by the Coronavirus Aid Relief and Economic Security Act CARES Act for borrowers affected by the. Web Millions of homeowners whove lost their incomes qualify to defer payments.

Web How COVID-19 payment deferral works. Web An amended federal law allows loan servicers to offer a payment deferral option to homeowners who finish a coronavirus-related forbearancewithout requiring a complete loss mitigation application. Web If you suspect that you will need to defer a payment then you should speak with the lender as soon as possible.

The deferred payments will be due at the end of the loan such as when your loan is paid off refinanced or your home is. Web If you are experiencing difficulty making on-time mortgage payments due to the national coronavirus emergency forbearance may be an option for you. If you accept the servicers offer you pay the skipped payments at the end of the loan rather than say paying the overdue amounts in an immediate.

Download transcript Forbearance is when your mortgage servicer thats the company that sends your mortgage statement and manages your loan or lender allows you to pause or reduce your. Web COVID-19 payment deferral. Web With the COVID-19 Payment Deferral you essentially return to making your regular mortgage payments and the maturity date remaining term interest rate and payment schedule will remain unchanged once you do so.

Web For a borrower receiving a COVID-19 payment deferral include the following. Web The payment deferral home retention workout option enables mortgage servicers to assist eligible homeowners who have resolved a temporary hardship and have resumed their monthly contractual payments but cannot afford either a mortgage reinstatement or repayment plan to bring the mortgage loan current. The payment deferral option allows borrowers who are able to return to making.

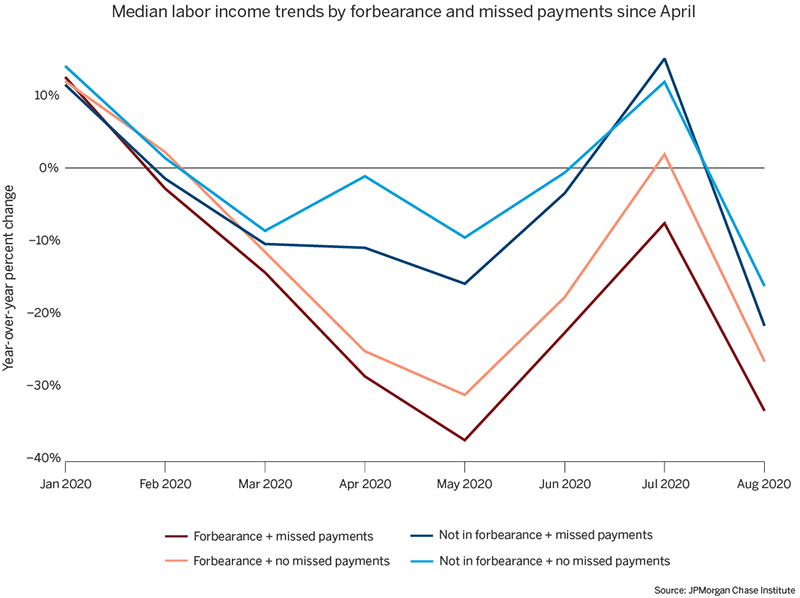

Still while a good portion of Americans have taken advantage of. To assist homeowners Fannie Mae has announced a new COVID-19 payment deferral program. Web Whether deferral is an option for you depends on who your mortgage investor is how many payments have been missed and your ability to resume making your regular monthly mortgage payment.

Web In effect that means shed owe the three months of deferred mortgage payments plus that months mortgage payment about 8800 as early as June far more than she was expecting or able. With this in mind many lenders will typically approve a deferral if you can prove that you are experiencing financial hardships. Web This mortgage relief option moves past-due amounts from missed payments to the end of your loan term so you can keep the same monthly payment while bringing your loan to a current status.

Web Forbearance is a method of dealing with temporary financial hardship. Web With the COVID-19 Payment Deferral you essentially return to making your regular mortgage payments and the maturity date remaining term interest rate and payment schedule will remain unchanged. The COVID-19 payment deferral may be the best option for you if your COVID-19 related hardship has been resolved and you are able to continue making your full monthly mortgage payment but cannot afford a full reinstatement or a repayment plan to bring your mortgage loan current.

You pause mortgage payments because you are facing economic difficulties. Another option is sometimes. Income statements medical bills and termination letters can all be used as proof of your financial hardship.

Web A mortgage deferral allows borrowers to move past-due house payments to the end of their loan term. Web Announced in the March 25 2020 Guide Bulletin the Freddie Mac Payment Deferral is a loss mitigation solution designed for Borrowers who became delinquent due to a short-term hardship that has since been resolved. As millions of Americans turn to their mortgage servicers for help during the COVID-19 pandemic its increasingly important that homeowners have a clear way to repay the amount owed after the financial hardship is resolved.

This may result from the COVID-19 pandemic a job. Payment Deferral addresses a unique hardship situation homeowners with a resolved short-term hardship who are financially capable. After youve repaid the payments you skipped your monthly payments would return to the normal 1000.

Web Determining Eligibility for a Payment Deferral for a Texas Section 50 a 6 Loan A Texas Section 50 a 6 loan is eligible for a payment deferral if the requirements described in Determining Eligibility for a Payment Deferral are satisfied and the application of a payment deferral to the mortgage loan complies with applicable law. If you can no longer afford your original payment you may have to look into other options such as a loan modification or the possibility of selling your. So your total mortgage payment would be 1250 until you make up the skipped payments.

Web Doing the math that comes to 250 added to your regular mortgage payment each month for one year. Web Washington DC. Behind on mortgage payments or at the end of a forbearance plan.

Today to help homeowners who are in COVID-19 related forbearance the Federal Housing Finance Agency FHFA has announced that Fannie Mae and Freddie Mac the Enterprises are making available a new payment deferral option. It makes the home loan current immediately without requiring the homeowner to make a lump-sum payment on the past-due amounts.

Homeowner S Guide To Mortgage Deferral And Mortgage Forbearance Programs

Did Mortgage Forbearance Reach The Right Homeowners

Payment Deferral Know Your Options

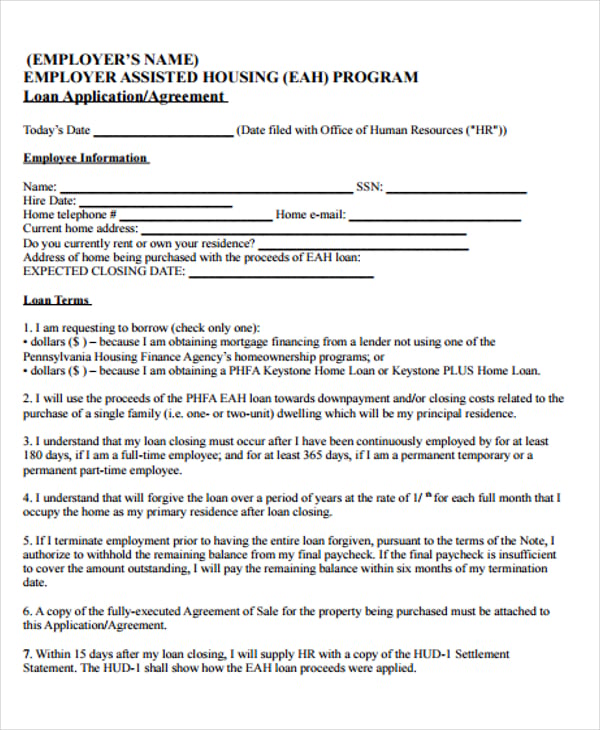

25 Loan Agreement Form Templates Word Pdf Pages

Pin By Mark Fleming On Work Contract Template Loan Money Personal Loans

Mortgage Payment Deferral March 26th 2020 Youtube

Covid 19 Resources For Employers Smbs Financing Employment Laws And New Developments Aharoni Business Law

:max_bytes(150000):strip_icc()/GettyImages-1305552503-6da2e8fbb9ca466083f810a77ca46ab8.jpg)

Mortgage Deferment Vs Forbearance What S The Difference

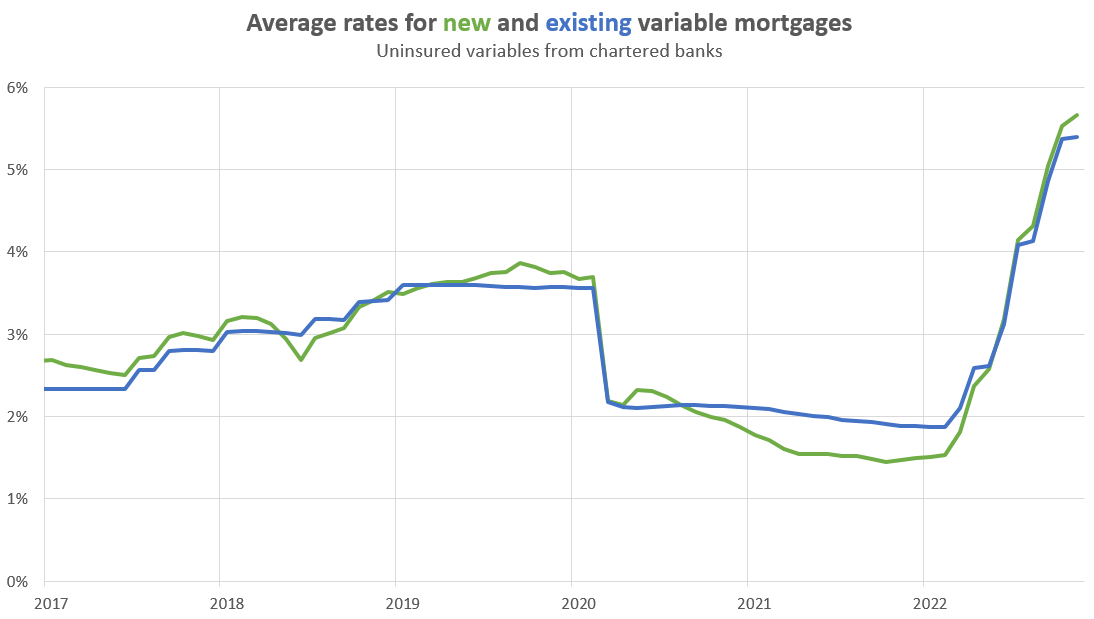

Changing Rates And The Market House Hunt Victoria

Scientific Bulletin

Beware Of Forbearance And Deferred Payments

What Is Mortgage Deferral And How Does It Help Homeowners

26 Promissory Note Templates Google Docs Ms Word Apple Pages

Homeowner S Guide To Mortgage Deferral And Mortgage Forbearance Programs

Wauconda Area Chamber Of Commerce Inicio Facebook

Changing Rates And The Market House Hunt Victoria

11 Questions To Ask Your Lender About Deferring Mortgage Payments