Recovery rebate credit 2020 calculator

However based on the 2020 AGI this single taxpayer will. In addition 500 was paid for each qualifying child for the first EIP 600 for the second and 1400 for the third.

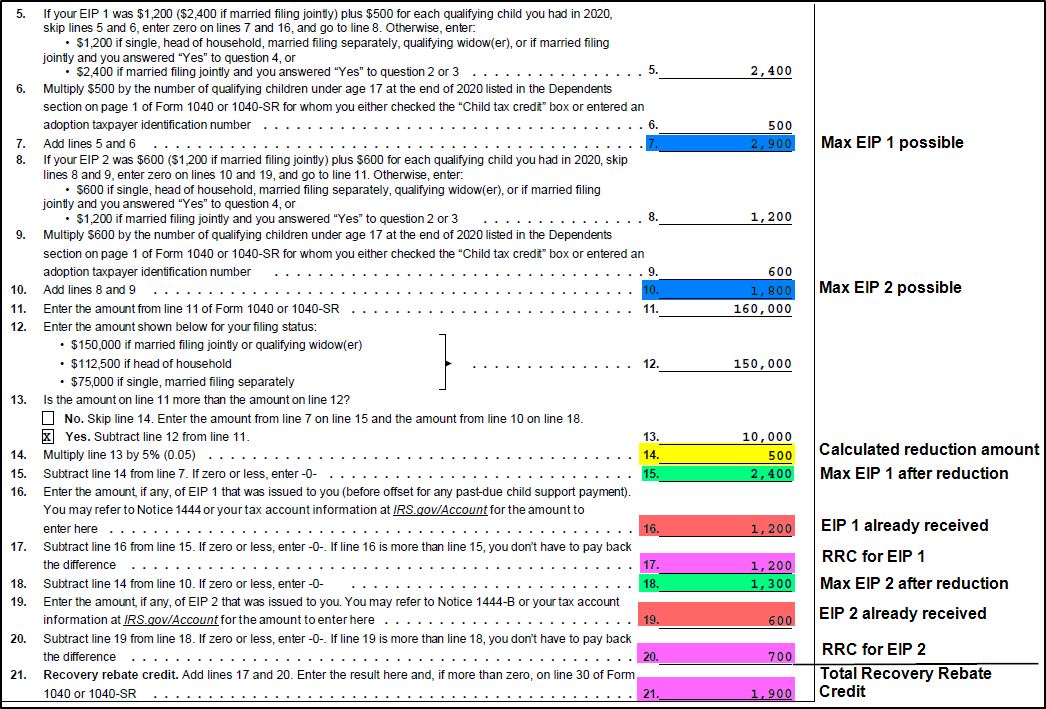

Recovery Rebate Credit Worksheet Explained Support

To calculate your second stimulus check authorized by the COVID-related Tax Relief Act of 2020 December 2020 please use our Second Stimulus Check Calculator You probably heard on.

. Last updated September 12 2021 609 PM 2020 Rebate Recovery Credit Calculation The IRS has not allowed a Turbo Tax calculated 2020 Rebate Recovery credit in. You must file a 2020 tax return to claim a 2020 Recovery Rebate Credit even if you dont usually file a tax return. If you didnt get the full amount of the first and second Economic Impact Payments you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you dont usually file taxes - to claim it.

These updated FAQs were released to the public in Fact Sheet 2022-26 PDF April 13 2022. The Recovery Rebate Credit was added to 2020 individual tax returns in order to reconcile the Economic Impact stimulus Payments issued in 2020. The law also provided for an advanced payment of the Recovery Rebate Credit RRC in calendar year 2020.

See the 2020 Recovery Rebate Credit FAQs Topic A. You will record the amount you. The eligibility requirements for the 2020 Recovery Rebate Credit claimed on a 2020 tax return are the same as they were for the first and second Economic Impact Payments.

Unlike the 2020 Recovery Rebate Credit the 2021 credit includes additional amounts for all dependents not just children under 17. If youre married filing a joint tax return or a qualifying widow er the amount of your second stimulus check will drop if your AGI exceeds 150000. Residents will receive the Economic Impact Payment of 1200 for individual or head of household filers and 2400 for married filing jointly if they are not a dependent of another.

If you claim the head-of. Instead you will need to claim the 2020 Recovery Rebate Credit on your 2020 tax return if eligible. People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return.

Eligible individuals can claim the 2021. Recovery rebate credit calculator Kamis 01 September 2022 Edit. This is made up of 2900 1200 for Alex 1200 for.

Below are frequently asked questions about the Recovery Rebate Credit separated. Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4700. If your 2020 return was filed andor processed after the IRS sent you a third stimulus check but before December 1 2021 the IRS sent you a second plus-up payment for.

These payments are referred to as Economic Impact Payments EIP1s. The gross amount based on either the 2018 or 2019 tax returns of the payment is reduced by 5 for each. Filers are eligible for a 1200 rebate according.

The amount of your recovery rebate credit however is fully determined by the data on your 2021 tax return. If you are filing your 2020 tax return before your trace is complete do. When they file their 2020 return they will claim their child on the return and determine they should receive 1100 in additional recovery rebate credit 500 for round one plus 600 for round two.

They were both single on their 2019 returns and they each received 1200 in first round of stimulus checks in 2020. Every United States resident or citizen who filed a tax return in 2018 or 2019 may be eligible to receive a recovery rebate under the CARES Act. DO NOT include information regarding your first or second Economic Impact Payment or 2020 Recovery Rebate Credit.

In this case going by the 2020 AGI the stimulus payment check was received but in a reduced amount - around 950. Your recovery rebate credit is calculated using a base amount.

How Much Money You Ll Get From The 2020 Coronavirus Recovery Rebate

Recover Rebate Credit

Recovery Rebate Credit 2021 Tax Return

Ready To Use Recovery Rebate Credit 2021 Worksheet Msofficegeek

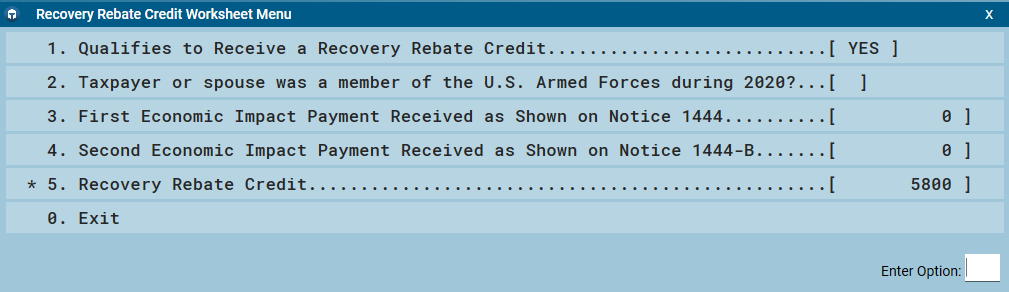

Desktop 2020 Recovery Rebate Credit Support

Missed Stimulus Check Deadline Don T Worry You Can Still Claim It As A Credit Here Is How Internal Revenue Code Simplified

Irs Cp 11r Recovery Rebate Credit Balance Due

Recovery Rebate Credit 2021 2022 Credits Zrivo

1040 Recovery Rebate Credit Drake20

Irs Cp 12r Recovery Rebate Credit Overpayment

Recovery Rebate Credit H R Block

Expect Refund Delays If You Claimed The Recovery Rebate Credit On Your 2020 Tax Return Donovan

Recovery Rebate Credit Worksheet Explained Support

Recovery Rebate Credit On Amended Return

2020 Recovery Rebate Credit Topic G Correcting Issues After The 2020 Tax Return Is Filed Nstp

How Can I Claim The Additional Stimulus Money For My Qualifying Dependent S If I Never Received It Support

Recovery Rebate Credit How Much Can I Claim For 2021 Melton Melton